What Is Credit Repair?

The whole process to recover the damaged and inaccurate information from your credit report is called the Credit Repair. When you are fed up with your bad credit report, you need to opt for credit repair to Fix Poor Credit Rating. It may be simple or difficult mistake happened by credit agencies such as identity theft, damaged incurred, extensive credit repair, etc. alternate definition of credit repair is, your settlement with financial problems like budgeting that may sort by concerning with credit score lenders.

Well, there are a number of companies offering credit repair services but when you go to deal with, you may have some questions whether the Credit Repair Company is trustworthy or not. It simply depends on the extent of your issue whether you need simple removal of misunderstanding or wants expert intervention. In order to rely on the respective company, you must know most of the companies are legally established. You can go through its law existence for your trust satisfaction.

What Are Tradelines?

Tradeline Credit account records that are provided to credit reporting organizations. A tradeline, also spelt as tradeline, can consist of a mortgage, line of credit, credit card, or any other credit-related element that is provided by a financial institution or lender.

The simple definition of Tradelines is, it is the best tool to boost your credit score. Tradeline is an alternate word of account or can be explained as a record for sorts of credit extended to the borrower and credit report to the relevant agencies. tradelines is maintained on the credit report of a borrower when the credit is approved by a borrower. It is associated with all the activities happened with an account. Tradeline is widely used for the credit reporting agencies to maintain the credit score of a borrower. Every credit reporting agency has its own terms for credit report of the borrower. Regardless the account is good or bad, tradeline it best to make up your credit report. Tradeline Credit Report contains the name of the creditor and lender, types account and relevant identifier to the account, name of the parties paying the loan repayment and the payment status. All this and relevant information is collected by three bureaus these are Experian, Equifax and Transunion.

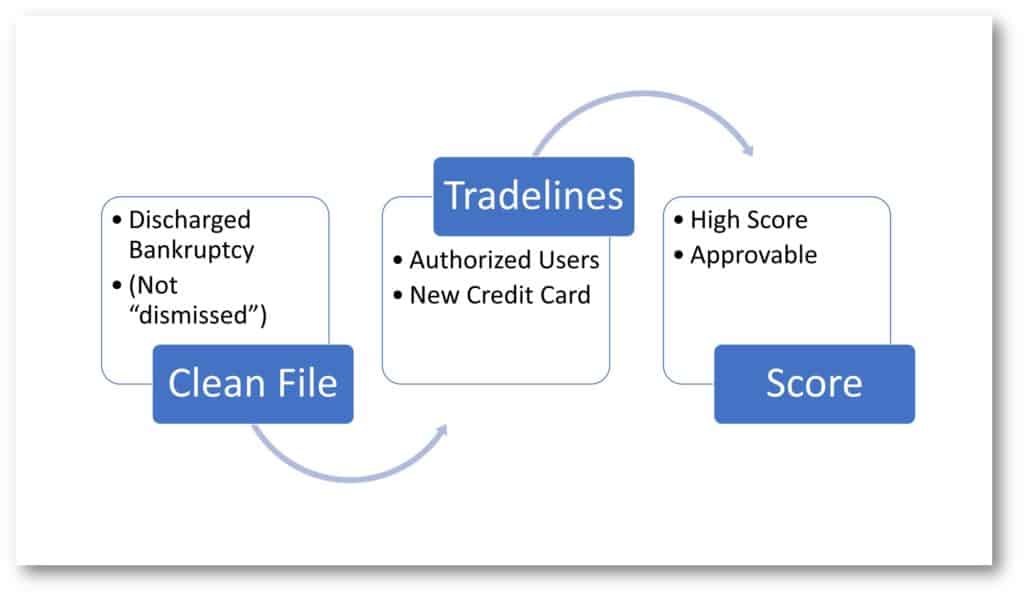

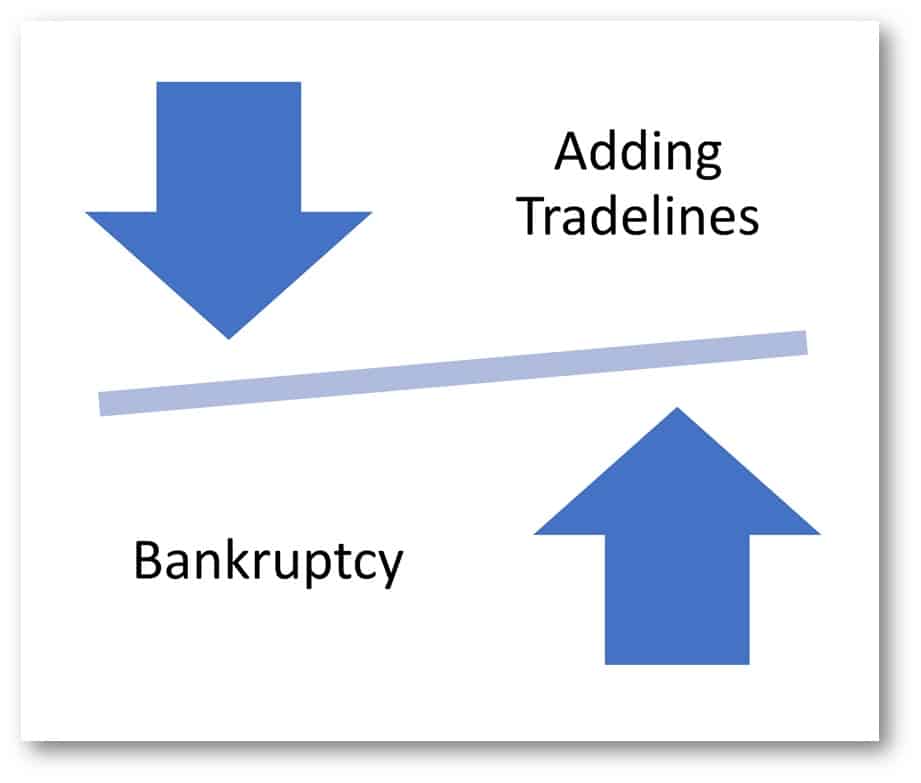

How Tradeline Works On Credit Repair?

It is one of the common questions and the answer is, you can simply add the authorized user to a credit card, be it your any relative, the close friend, known or a stranger. The lender needs to deliver the FICO Credit Score info regarding the authorized user account credit institutes or firm as well as the lender should maintain this info for evaluating the credit history.

Tradeline is a simple process to add an Authorized User Tradelines who needs to maintain additional loans towards the success which he/she is unable to do with his/her own poor credit limit. As you know several reasons behind the bad credit score ask for the instant credit repair, using tradeline credit, the continuous use of rented credit score by the borrower will perform to Rapid Rescore Credit Score of the lender credit score. This will offer the profits to both credit lender and borrower. The lender will earn more and the borrower will get success with mandatory repair of credit score.