It may seem easy but it is not. The premises of any credit scores can be figured out on the basis of your credit report. Your credit report simply tracks the payment records, history and credit score.

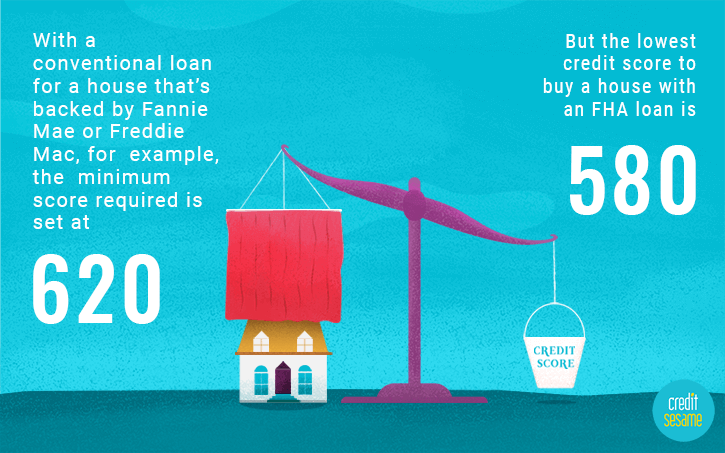

The ranking of the credit scores is calculated using FICO Credit Score released by Fair Isaac Corporation, As the higher FICO is better. These 3 digit number enables you to predict good or bad credit risk. You will pay higher rates on loan if you score below 650 ranges.

Overall the credit score is calculated or generated on the basis of your Credit Report which includes the following factors:

- The number of accounts

- Types of accounts

- Used credit vs available credit

- Length of credit history

- Payment history

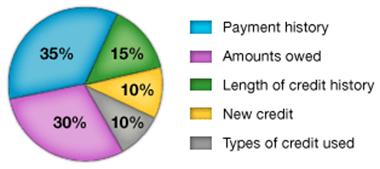

However, the Fair Isaac Corporation is tight-lipped to describe the exact scores to calculate the FICO Score Vs Credit Score. But here are described the various criteria with weight to generate the credit scores.

The Five Credit Scoring Factors

Following are the five credit scoring factors, an individual should have to maintain for Boost Credit Score Faster in a quick time or days. These factors can help you all to buy luxury home & lifestyle, increase in credit card limit and grow up from the economic deal.

Payment History (35%)

Your payment history also determines how you grow rapid credit score you have been extended on credit account including lines of credit, retail department store accounts, auto loans, installment loans, finance company accounts, student loans, home equity loans, mortgage loans, etc. This factor also includes the detail of missed and late payments, public record accessories and collection information, bankruptcies, wage attachments, liens, foreclosures and all kind of delinquencies reported to collection agencies. It tracks the causes for Rapid Rescore Credit Score and other that made you for the late payments, etc. the payment history also contains the details of a number of accounts that are delinquent in relation to entire your accounts in the report. It releases the biggest impact to determine your credit score.

User Credit Vs Available Credit (30%)

It carries the details of how much your total credit line is used on your credit cards and any other revolving lines of credit. The revolving line of credit allows the user to borrow, repay and reuse the credit line till the availability of the limit. In the total line of credit, an individual can charge the maximum credit limit up to $2,500 to an account. Its important fact is how one manages monthly payment.

Types Of Credit Used (15%)

Credit scores also show the various kinds of credit accounts or Tradelines one is consuming such as revolving debts and installment loans. The important factor that impacts the number of Tradelines you have. Creditors track whether you are able to maintain multiple Installment Tradelines of distinct sorts of credit score algorithm showing this.

New Credit (10-12%)

The credit score tracks the number of new credit accounts you opened as compared to the total number of Tradelines in your credit report. It reflects how many earlier credit requests have initiated as referred by hard pulls by creditors to credit reporting companies. A credit score is not taken into account requests that a creditor made your credit report to create a pre-approved credit offer.

Length of Credit History (5-7%)

The credit score calculation records both the length and age of recent open accounts. Its simple purpose is for the creditor to track whether the consumer is able to handle credit accounts for the particular time period. It also monitors how long the different types of accounts have been managed by you and whether the creditor has a public record as mentioned on your credit history.

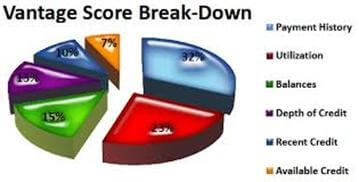

These are the factors which used to calculate and Rapid Increase Credit Score. Years ago a group of Fair Isaac Corporation and national credit bureaus developed this criterion to manage a predicted risk to help the credit lenders and maintain the credit records of everyone. Recently, the three agencies of America created Vantage Score to support the approach of credit scoring and let the lender know risk assessment across the three credit reporting bureaus. The total credit score ranges are:

- FICO: 300 – 850

- Experian: 330 – 830

- Equifax: 300 – 850

- TransUnion: 300 – 850

- VantageScore: 501 – 990 (often assigned a letter grade, A – F)

This is the whole process which affects in calculating and generating the Credit Scores.