Introduction

Are you facing any kind of issue in managing your credit score? Or do you want to boost credit score fast? If yes, then this article is for you. As in this article, we are going to discuss how to fix a poor credit rating in a short period of time.

General Information

As we all know that credit scores are based on borrowers’ payment histories. Since the 1990s, most of the consumer-lending decisions in the US are completely relying on the FICO (Fair Isaac Corp.) scoring system.

Why Ultra FICO?

Basically, The Ultra FICO score is intended to increase the number of endorsements for credit cards, personal loans, and other debt by considering a borrower's history of money exchanges, which could demonstrate that they are so liable to reimburse.

Well, today, we are going to discuss some important facts by which anyone can increase their credit score rapidly without doing anything special.

1. Maintaining a bank account over time

2. Avoiding having a negative balance

3. Regularly paying bills and making other bank transactions

4. Add Rent Info to your credit files

5. Try Piggybacking

These are basic things by which you can easily raise your FICO score. Apart from this, there are some other methods of rapid credit enhancement. At present, Priority Tradelines is greatly known for increasing the FICO credit score.

Improve Your Fico Score Within a Month

If you really want to improve your fico score within a month, then it’s good to consult these professionals as all the above-listed methods are very time-consuming and better for long-term results, but if you want instant results within a month or two than in that case, Tradelines is the best option for you.

Tradelines

Tradelines are a credit enhancement tool which offers you the opportunity to enhance your credit report by adding you as an authorized user to your credit report. These accounts have a perfect payment history, low balance and are in good standing. Once you are added you will benefit from the payment history and, will see a change in your credit score. People from all over the United States have had the opportunity to buy new cars, homes, apply for business & personal loans.

As you see that with Tradelines, you have a full-proof record of every single transaction. It helps you to create a healthy credit history to your credit report.

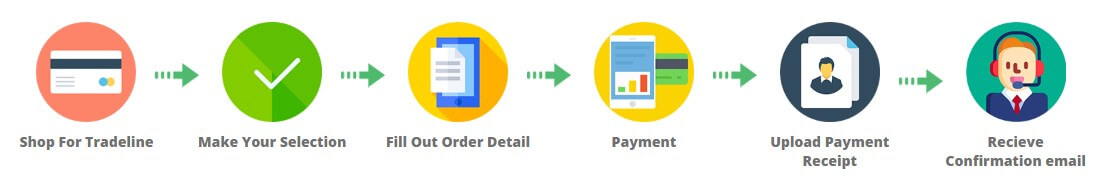

Tradelines Process

Here is the complete process of Tradelines. Have a look!

It is a hassle-free process as just doing normal online shopping.

A New Fico Credit Score

There is one good news for all the customers, FICO gives an amazing new year gift to all the clients as they are going to launch their new FICO credit score in 2019 that means it’s the time to start your new year by having all those things that you are dreaming of for a long time.

The Ultra FICO Score

Fundamentally, it is an opt-in credit model that uses information from your checking, savings or money market accounts to supplement data already in your credit report. This information being considered includes how much you have in savings, how long the accounts have been open and how active they are. It’s meant to boost your existing FICO score.

Conclusion

In today’s fast-paced world, no one gives you a guarantee but Priority Tradelines guarantees you that your selected tradeline will have low utilization and great credit history that gives you the biggest possible Ultra FICO score boost in less than 30 days!

So guys, what are you waiting for? Don’t miss this ultimate chance and start boosting your credit score now! If you want any kind of expert help in mortgage approval, auto loan, restore credit score, personal loan, business loan and reduced interest rate then feel free to contact us https://prioritytradelines.com